News & Reminders

Announcements

All's Well: CUNY Puts Wellness at Your Fingertips

Note: The PSC-CUNY Welfare Fund cares about your health and wellness. To help you achieve an active and healthy lifestyle, we will regularly consult with the most trusted sources of health and wellness information and bring you news and tips about fitness, nutrition, and mental health.

This month’s news:

Take a Moment and Explore the CUNY Employee Wellness Program

Here at the PSC-CUNY Welfare Fund, we like to say “Know your benefits. Use your benefits.” Same goes for the CUNY Employee Wellness Program.

Want to use meditation to relieve anxiety? Here’s how.

Want to boost your financial wellness? Get ready to see your bank account swell.

How about a coloring book that reduces stress? Right here.

There’s all this and much, much more. We all want to be happier and healthier. The CUNY Employee Wellness Program is a great place to start.

CAUTION: Politics Ahead

All’s Well is agnostic about politics. But that doesn’t mean we are not being strategic and prepared for the next four years and what it means for your benefits. The International Foundation of Employee Benefit Plans has a clear-eyed take on the incoming administration here.

Free Lunch? Sorry. Free Eyeglasses and More? Yes!

Many Welfare Fund benefits have no out-of-pocket costs. Don’t miss out.

The PSC-CUNY Welfare Fund Trustees know you appreciate a good deal. That’s why we have made sure many of the benefits the Fund offers have no copays or out-of-pocket costs. At a time when the family budget is being stretched thin, it’s nice to know the Fund helps you keep your dollars in your pocket.

Below is a list of the free or no copay benefits available. Don’t worry, there’s no small print – just a few steps to remember to make sure you realize your savings.

Prescription drugs:

Generic medications are a great way to save money. First, you must be enrolled in basic health insurance through the NYC Health Benefits Program (NYC HBP) to be eligible for prescription drug benefits under the Fund’s supplemental benefits program.

Actives, Adjuncts and Retirees enrolled in the PSC-CUNY Welfare Fund Prescription Plan have no copay when filling a prescription for a generic drug included in the PSC-CUNY Welfare Fund Drug List and when the prescription is filled at a CVS pharmacy or through the CVS Mail program.

Remember, hundreds of preventative medications – from aspirin and low-dose statins to Zyban – also have no copay if you are enrolled in the Emblem Health plans, GHI-CBP and HIP. Go here for more information.

Preventative medications are available, free of charge, by presenting your GHI-CBP or HIP HMO card along with your doctor’s prescription. You are required to fill prescriptions for maintenance medications by ordering a three-month supply at a participating Walgreens pharmacy or by mail order from Express Scripts. Find a participating Walgreens here.

Vision:

Seeing is believing – eyeglasses and contact lenses are a bargain if you’re a Fund member.

You may choose any Fashion, Designer or Premier-level frame from Davis Vision’s Frame Collection, free of charge. There’s no copay for special lenses or coatings. You get the same great deal if you choose contact lenses instead of glasses.

Here’s a tip: You and your eligible dependents are entitled to a pair of glasses (lenses and frames and an optometric examination) once per calendar year, to be purchased at any time during the calendar year. So if you haven’t treated yourself or a family member to new glasses this year, get a pair as a holiday gift. Even better, you can get another pair for free anytime in 2023. Go here for more information.

Hearing:

Hearing aid benefits may not be free, but they are amazingly affordable. The HearUSA plan is available to you and your covered dependents every 36 months. HearUSA’s standard hearing aids are available with no copay. If you think a hearing aid may be part of your future, you are eligible for a free annual hearing screening.

IMPORTANT HEALTH COVERAGE TAX DOCUMENTS

PSC-CUNY Welfare Fund members who need IRS form 1095-B for the 2024 tax year can obtain the personalized form by emailing communications@psccunywf.org

Form 1095-B is used to report certain information to the IRS and to taxpayers about individuals who are covered by minimum essential coverage. Eligibility for certain types of minimum essential coverage can affect a taxpayer’s eligibility for the premium tax credit.

$0 Generic Prescription Drug Copay Program

Active members and Retirees under 65 enrolled in the PSC-CUNY Welfare Fund Prescription Plan, as well as Retirees enrolled in the SilverScript Medicare Part D Prescription Plan have no copay when filling prescriptions for generic medications covered by the Welfare Fund CVS formulary or the SilverScript formulary if the prescription is filled at a CVS pharmacy or through the CVS Mail program. Generic drugs purchased at a pharmacy other than CVS are not included in the program and are subject to the usual copay.

Ease the Copay Pain

Prescription drugs and copays are an unfortunate reality.

Thankfully, the PSC-CUNY Welfare Fund utilizes many ways to limit – or eliminate – the copays members face when they fill a prescription.

When faced with a high copay, first talk to your pharmacist and/or physician to determine the reason why. Ask if there are ways to reduce the copay. If no solution is at hand, contact the PSC-CUNY Welfare Fund for advice and guidance. Phone 212-354-5230 or email communications@psccunywf.org.

Copays are eliminated when active members and retirees under 65 enrolled in the PSC-CUNY Welfare Fund Prescription Plan, as well as retirees enrolled in the SilverScript Medicare Part D Prescription Plan, opt for generic medications covered by the Welfare Fund CVS formulary or the SilverScript formulary. The prescription must be filled at a CVS pharmacy or through the CVS Mail program. You can find the formulary, or list of covered drugs, at www.psccunywf.org.

If a generic version of the drug you are prescribed is not available, there will likely be a copay. Don’t despair, here are some ways to reduce copays:

Tip: Using a drug on the CVS formulary helps reduce the copay by up to 50%. Make sure you check the formulary list to see if the drug you are prescribed is on the list before you visit the pharmacy. If not, ask the pharmacist or your physician if there is an equivalent medication on the list.

Tip: Use 90-day refills at CVS. Medications on the formulary list filled monthly carry a 20% copay for the first three refills. After that, the copay increases to 35%. Using a 90-day refill by CVS mail order or at a CVS pharmacy keeps the copay ay 20%.

Tip: Use coupons. Many of the name-brand drugs you see advertised on television are very expensive. But the manufacturer often offers coupon discounts – if you look for them. Check out the manufacturer’s website or Google the drug name and you may find what you’re looking for.

Tip: Statins are among the most common prescriptions. Remember that GHI-CBP and HIP HMO health care plans cover most low-dose generic statins at no copay for any eligible members between 40 and 75 years of age, when using Walgreens or Duane Reade pharmacies. GHI-CBP and HIP HMO participants do not use their CVS prescription cards for these medications but will provide their Emblem Health cards at the pharmacy. Find the list at www.psccunywf.org.

Still facing exorbitant out-of-pocket drug costs? You may be eligible for the Fund’s “Hi-Cost Rx Program.”

Active, adjunct and under-65 retired Fund members will be able to apply for reimbursement when their Welfare Fund prescription drug expense exceeds $10,000 and their eligible out-of-pocket costs exceed $2,500 on an annual basis. The Fund will reimburse up to $25,000 per person per plan year. The first $2,500 of out-of-pocket is treated as a deductible and not eligible for reimbursement.

All in-network pharmacy claims may be eligible for reimbursement if they are for drugs on the PSC-CUNY Welfare Fund’s CVS formulary or drugs with a valid prior authorization. Specialty Drug claims are eligible ONLY through the CVS Specialty program.

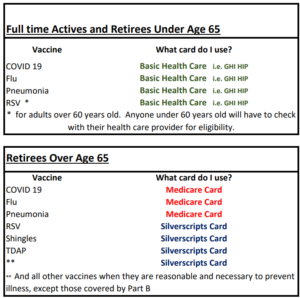

RSV, Covid: Protect Yourself

The cold and flu season is here, and recent news about the Covid, RSV and flu vaccines has many PSC-CUNY Welfare Fund members wondering what steps they should take.

According to the federal Centers for Disease Control (CDC), adults at the highest risk for severe Respiratory Syncytial Virus (RSV) illness include older adults, adults with chronic heart or lung disease, adults with weakened immune systems, and adults living in nursing homes or long-term care facilities. The CDC estimates that every year, RSV causes approximately 60,000–160,000 hospitalizations and 6,000–10,000 deaths among older adults.

In early 2023, the CDC recommended that people aged 60 and older should consider newly developed vaccines for RSV. The CDC this month also recommended that all Americans 6 months and older receive at least one dose of the latest Covid shots.

What actions should Fund members take?

First, consult your doctor, pharmacist, or health care provider. The Fund can provide guidance, but decisions about your medical care should always be made in conjunction with your health care professional.

Full time, active CUNY employees should contact their basic health care plan (such as GHI, Cigna, Aetna, etc.) to determine how to get their vaccine. The NYC Health Benefits Program’s Vaccine Finder website provides helpful information about the new Covid vaccines.

During the Covid pandemic, most Covid vaccines were available from the government at no cost. Today, Covid vaccines may carry a cost, depending on your health benefit plan. The same is true for the RSV vaccines.

The PSC-CUNY Welfare Fund’s prescription drug plan does not cover vaccines for active employees under age 65. Vaccines are covered for retirees age 65+, per PSC-CUNY SilverScript plan. PSC-CUNY Welfare Fund members who are active and under age 65 should contact their health benefit provider to determine vaccine coverage. Fund members enrolled in the NYC Health Benefits Program can call 212-306-7200 for information.

Where can you go for the vaccines?

Talk to your pharmacist or doctor about the RSV vaccine. Most pharmacies will offer the RSC vaccine through your city health care plan. Retirees most likely will not have a copay. Active employee may have a copay.

Fund members, as always, should consider the annual flu shot. Flu shots are widely available at pharmacies at little to no cost.

Welcome TruHearing: Your New Hearing Health Benefits Provider

The PSC-CUNY Welfare Fund has enhanced its hearing benefits by switching providers from HearUSA to TruHearing, a company that offers access to a wider selection of providers. TruHearing offers lower out-of-pocket costs, and they offer a much wider variety of premium hearing aids. Since HearUSA is part of the TruHearing family, you can expect a seamless transition to the new provider and can continue to use HearUSA offices.

Contacting TruHearing to schedule an exam is easy: call 1-877-653-8967 (TTY:711).

Some of the TruHearing highlights include:

- The same $1,500 per ear benefit, every three years

- Lower loss/damage policy deductible

- Savings on premium and advanced level devices

- Larger network: 6,400 unique providers, including all HearUSA centers and the majority of HearUSA network providers

- Charger included on all rechargeable devices

- Cap of $65 on cost per visit for visits after the first year of free visits

- Many mobile options available

All current eligibility rules remain in place.

Guardian Dental Changes

During the annual review of Guardian dental coverage, the Fund discovered an unexpected rise in dental implant expenses. Upon further review, it was found that the increased expense was directly related to the benefit enhancement for dental implants that took effect on July 1, 2022. This enhancement allowed members to receive more than two implants within one calendar year, which was not the intended outcome when the Board of Trustees made the plan changes.

Therefore, effective Feb. 1, 2024, dental implants under the Guardian plan will be limited to two (2) implants per calendar year, subject to the following rules:

Members who received an implant(s) pre-determination letter, but did not have the implant procedure(s) completed by January 31, 2024, will not be allowed more than two (2) covered implants during 2024.

- If two (2) or more implants are completed in January 2024, no implants will be covered for the remainder of the 2024 calendar year.

- Coverage for implant procedures completed on or after Feb. 1, 2024 and for the remainder of the calendar year is limited to two (2) implants.

- Members with existing pre-determinations for implant procedures that are not performed prior to Jan. 31, 2024 should request a new pre-determination letter.

Appeals

Members have the right to file an appeal. The established appeal process can be found in the Welfare Fund’s SPD which you can view at www.psccunywf.org.

New for 2025: Changes to Medicare Prescription Drug Plans

Retired members of the PSC-CUNY Welfare Fund who are over age 65 are likely to notice some important changes to the Fund’s SilverScript Medicare prescription drug plan in 2025.

Here’s what you need to know:

The federal government’s Inflation Reduction Act features a new $2,000 “true out-of-pocket” (TrOOP) drug spending cap, which will mean lower out-of-pocket costs for some Part D enrollees but increasing costs for the Fund’s SilverScript plan overall. The previous cap was as high as $8,000.

The Fund pays 75% of the Medicare-mandated $590 member deductible for drugs on our formulary. That means retired Fund members’ TrOOP is less than $2,000 – closer to $1,550. Retired members taking expensive medications will likely find their drug costs are more affordable, since there is a $0 copay when the $1,550 TrOOP is reached.

In response to the Medicare-mandated 2025 TrOOP cap, which shifted a significant portion of the Medicare Part D cost to the Fund, it became necessary to adjust member copayments. To help manage this increased financial burden, the Fund increased the member copay from 20% to 25% for prescriptions until the $2,000 TrOOP cap is reached.

The Fund remains committed to minimizing any cost increases, especially if such increases might result in potential cuts to other retiree benefits. Nonetheless, absorbing the entirety of this Medicare-mandated cost hike would likely necessitate reductions in other retiree benefits. Our primary goal is to continue offering our retiree members the best possible prescription drug benefit while striving to keep drug costs as low as possible.

Why were these changes to federal law made? The lower cap is expected to help millions of people, especially those taking costly, life-saving medications. By April 1, 2024, more than 1.7 million people, about 3.5 percent of people covered by Medicare D drug plans, had already reached $2,000 in out-of-pocket costs on their prescriptions, according to the Centers for Medicare & Medicaid Services (CMS). More certainly surpassed that by the end of the year.

Please send any questions or concerns can to communications@psccunywf.org

Obtaining Paxlovid: Important Update

Paxlovid is the only FDA-approved treatment of mild-to-moderate COVID-19 in high-risk adults who may develop severe COVID-19.

Since January 2024, Paxlovid has been made available through a cooperative agreement between the federal government and the drug manufacturer, Pfizer. Consequently, Paxlovid is not currently on the CVS/Caremark drug formulary list.

A copay assistance program called Paxcess allowed Fund members with a prescription for Paxlovid to obtain the medication at little to no cost. Recently, however, Pfizer altered the terms of the program and many full-time, active and under age-65 Fund members have had to pay out of pocket for Paxlovid.

If you are having trouble obtaining Paxlovid or are paying out of pocket, please email the Fund at communications@psccunywf.org for assistance.

Currently, the fund is working with CVS/Caremark to ensure our members can fill Paxlovid prescriptions.

For retirees who are enrolled in Medicare, Pfizer offers the drug copay-free.

It is always recommended to consult with your doctor before taking any medication. Paxlovid is a prescription medication that is used to treat mild to moderate COVID-19 in people aged 12 years and older who weigh at least 40 kilograms (about 88 pounds) and who are at high risk for progressing to severe COVID-19 and/or hospitalization. Medical experts say Paxlovid must be taken within five days of COVID symptom onset to be effective.

IRMAA and Medicare Part B Reimbursements

Medicare Part B & Reimbursement information on the NYC Health Benefits Program website

Since 2007, Medicare members whose taxable income exceeds a certain threshold have been charged more than the standard Part B and Part D monthly premiums, in accordance with a surcharge schedule. The acronym for that extra charge is IRMAA, which stands for Income Related Monthly Adjustment Amount. This year the income threshold is $91,000 for individuals and $182,000 for couples filing joint tax returns.

The NYC Health Benefits Program will reimburse the amount of the Medicare Part B IRMAA increase. The reimbursement claim form and instructions are available at the bottom of the Forms section of this website. However, the IRMAA surcharge for Medicare Part D is not reimbursed.

The rules and rates for Higher-Income Medicare Beneficiaries are available on the Social Security Administration website here.